Health Care Matters | July 12, 2024

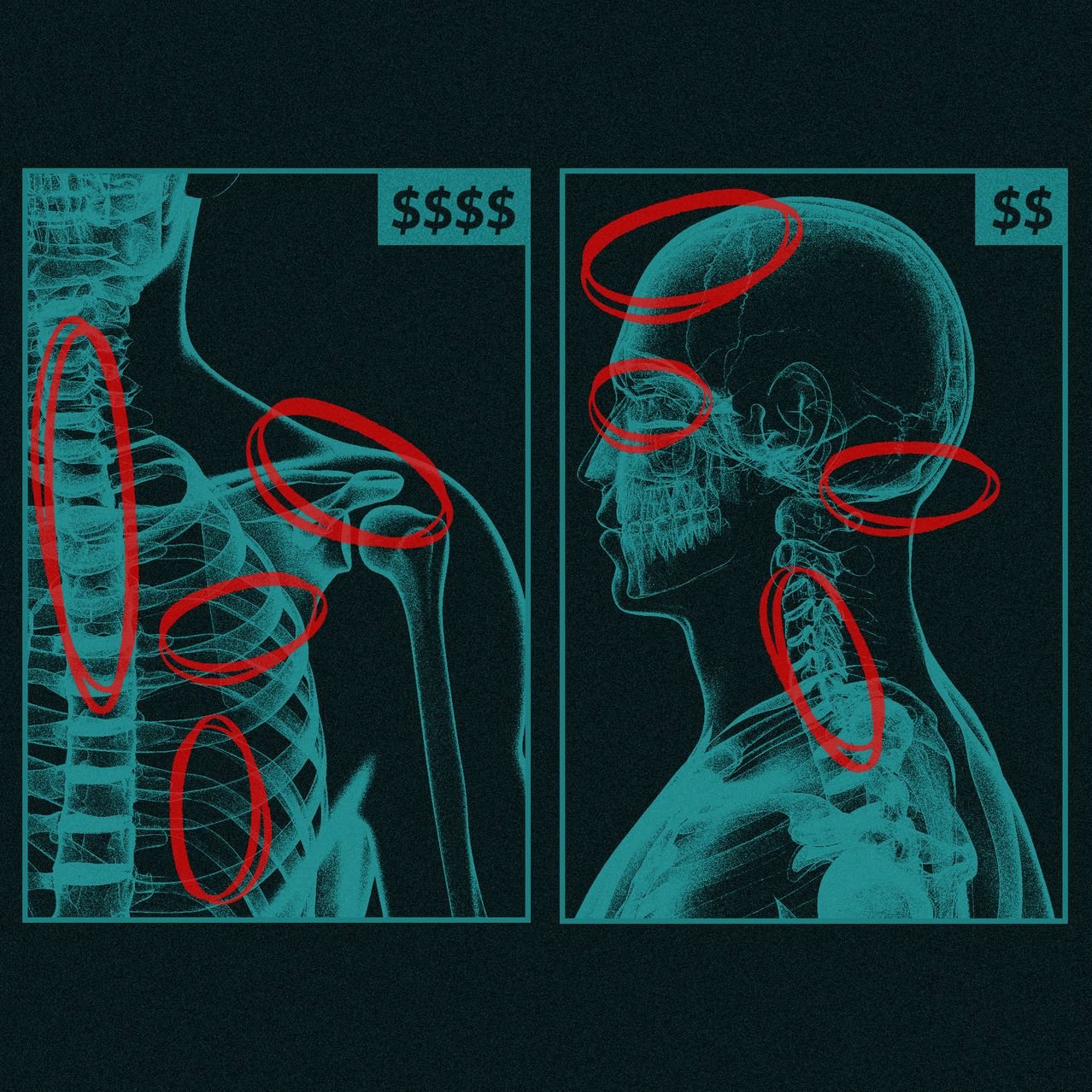

Medicare Advantage Plans Earned $50 Billion from Medicare Due to Questionable Diagnoses

The Wall Street Journal published an investigative report on July 8th based on a review of Medicare Advantage (MA) claims from 2018 to 2021. The WSJ’s analysis found many additional diagnoses for MA members where no treatment was received or that contradicted the patient’s doctor’s opinion. The WSJ noted that Medicare paid $50 billion for diagnoses added just by insurers during the 3-year period it examined.

Why It Matters

CMS pays insurers a base rate in MA that can increase based on a patient’s relative burden of illness. This is meant to ensure that patients with complex conditions and multiple illness have the time they need with their doctors and care team. In practice, CMS has long wrestled with the fact that paying more for additional diagnosis codes is perfectly designed to incentivize adding more diagnosis codes. MA plans (and ACOs alike) have invested in a myriad of approaches (code-recapture vendors, nurse home visiting, physician incentive programs, and AI) to maximize full and complete coding. The WSJ analysis uncovered specific instances where diagnoses that increased payment rates were predominantly added by insurers as opposed to providers. Diabetic cataracts was one such example. In many cases cataracts had already been cured through surgery and the diagnosis was no longer applicable. Insurers have pushed back on the report, stating the analysis was flawed.

The MA program has undergone increased scrutiny over recent years as more seniors elect private Medicare. The HHS Office of the Inspector General (OIG) issued a strategic plan on July 8th, designating oversight of managed care as a key priority. The last MA and Part D Final Rule included guidance on the use of AI, a phase in of a new risk adjustment model, removing 2000 codes, and changes to audit processes. We expect tough scrutiny will continue as MA enrollment (and therefore payments) become an increasingly large share of overall Medicare spending.

CMS Releases Evaluation Reports for the Vermont All-Payer Accountable Care Organization Model and the ACO REACH Model

CMS recently released the 4th evaluation report for the VT ACO Model covering 2018-2022 and the second report for the 2022 performance year on the Global and Professional Direct Contracting (GPDC) Model which morphed into ACO REACH in 2023. The Vermont report, in addition to quantitative analyses, provided lessons learned as the model comes to a close. Evaluators indicated a few key take-aways including the need for various pathways to risk, ongoing workforce challenges limiting ability to implement care transformation activities, and the required time and technical assistance support needed for success. The model showed modest savings over the 5 years of $790 per beneficiary compared to like beneficiaries in the Medicare Shared Savings Program which declined over time and were not significant in the 5th year. The ACO REACH report found significant increases in net spending for attributed beneficiaries compared to a Medicare FFS comparison group as well as some improvement in certain quality measures.

Why It Matters

CMMI is statutorily required to evaluate the effect on quality and cost for each model and these results help determine whether the model may be eligible to be scaled into the permanent Medicare program. The CMS Office of the Actuary considers evaluation findings when estimating potential savings for future models and when evaluating changes proposed to financial methodologies for existing models. Models and methodologies that fail to produce savings have a difficult time passing the Office of Management and Budget. In addition, the Congressional Budget Office may consider these reports when estimating the overall effect of CMMI on Medicare spending. The GPDC report in particular indicated increases in spending for standard Direct Contracting Entities (the majority of organizations participating), while organizations focusing on high needs patients, and those organizations new to treating Medicare FFS patients demonstrated reduced gross spending. Based on this report, it will be important to watch whether CMS continues to provide a pathway for these new types of organizations to participate and what changes may also be made to ensure the future models have an increased chance of producing savings after the conclusion of ACO REACH in 2026.

It’s Here! CMS Released the 2025 Physician Fee Schedule Proposed Rule

Changes proposed for physician payment, MSSP, quality reporting and more. Stay tuned for Coral’s insights on the PFS. Until then, look to these key sources:

WHAT WE ARE READING

CMS is Accepting Applications to the Innovation in Behavioral Health Model

Interested state Medicaid agencies have until September 9th, 2024, to apply.

The Road to Value Can’t Be Paved With a Broken Medicare Physician Fee Schedule

Robert Berenson and Kevin Hayes make a case for viewing value-based payment (VBP) and the fee schedule as complementary, with changes to the broken fee schedule critical for the success of VBP.

Mark Your Calendars!

Health Care Payment Learning and Action Network 2024 Summit

November 14th, 2024 at The Baltimore Convention Center.